When it comes to financing your education, it’s essential to understand the differences between federal and private student loans. Each type has its advantages and drawbacks, affecting your overall borrowing experience. In this comprehensive guide, we will explore the intricacies of federal and private student loans, providing detailed insights, examples, and useful links to help you make an informed decision. This article aims to demystify the loan comparison process and empower you to choose the best option for your educational needs.

Table of Contents

1. Federal Student Loans: An Overview

Federal student loans are funded by the U.S. Department of Education and offer several advantages:

- Types of Federal Student Loans: Federal loans come in various forms, including Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Direct Consolidation Loans. Each type serves specific purposes, such as subsidized loans, which do not accrue interest while you’re in school. Learn more about the types of federal loans here.

- Benefits of Federal Loans: Federal loans provide borrower-friendly benefits like fixed interest rates, income-driven repayment plans, and loan forgiveness options. For example, income-driven repayment plans adjust your monthly payments based on your income, which can be a great relief during periods of financial difficulty.

- Eligibility and Application Process: To apply for federal loans, you need to complete FAFSA, the Free Application for Federal Student Aid (which can be completed here). The FAFSA process is straightforward. This form determines your eligibility for federal grants, work-study, and loans. Be sure to meet the FAFSA deadlines, which vary by state and school.

2. Private Student Loans: An Overview

Private student loans are offered by banks, credit unions, and private lenders:

- Types of Private Student Loans: Private loans vary widely, and the terms and conditions depend on the lender. Some lenders offer fixed or variable interest rates, while others may provide different repayment options. Learn more about private loans here.

- Benefits of Private Loans: Private loans can fill the gap between your federal aid and the cost of attendance. They often have higher borrowing limits than federal loans and may not require federal eligibility criteria, making them accessible to a broader range of students.

- Eligibility and Application Process: Private loans typically consider your credit history. If you have a limited credit history or a low credit score, you may need a cosigner to secure a private loan. The application process involves submitting an application to your chosen lender, who will assess your creditworthiness.

3. Interest Rates and Fees

- Federal Loan Interest Rates: Federal loan interest rates are set by the government and are usually lower than private loan rates. For example, the interest rate on Direct Subsidized Loans for undergraduate students is often lower than the rate on unsubsidized loans.

- Private Loan Interest Rates: Private loan interest rates can vary widely based on your creditworthiness and the lender’s policies. Some lenders offer fixed rates, which remain the same over the life of the loan, while others offer variable rates that can fluctuate with market conditions.

- Fee Structures: Federal loans typically have lower fees compared to private loans. While federal loans may have origination fees, these fees are relatively small compared to private loan fees, which can include application fees, origination fees, and late payment fees.

4. Repayment Plans and Flexibility

- Federal Loan Repayment Plans: Federal loans offer a range of repayment plans to accommodate different financial situations. These include the Standard Repayment Plan, Extended Repayment Plan, Graduated Repayment Plan, and various Income-Driven Repayment Plans (IDRs). IDRs base your monthly payments on your income and family size, offering flexibility when your financial circumstances change.

- Private Loan Repayment Options: Private loans may offer various repayment options, but they tend to be less flexible than federal loans. Some private lenders offer interest-only payments while you’re in school, but they may not provide income-driven plans.

- Deferment and Forbearance: Both federal and private loans may offer deferment or forbearance options. Deferment allows you to temporarily postpone payments during certain situations, such as enrollment in school or financial hardship. Forbearance is another option to temporarily reduce or postpone payments, typically during times of financial difficulty.

5. Loan Limits and Borrowing Caps

- Federal Loan Limits: Federal loans have set limits on how much you can borrow each year and in total. These limits vary based on your student status (dependent or independent) and grade level (undergraduate or graduate).

- Private Loan Borrowing Limits: Private loan limits are determined by the lender and can vary significantly. They often have higher borrowing limits than federal loans but may require a creditworthy cosigner for larger amounts.

- Managing Loan Limits: To manage loan limits effectively, students can consider a combination of federal and private loans to meet their educational expenses while staying within borrowing limits.

6. Credit Requirements and Cosigners

- Federal Loans and Credit: Federal loans do not require a credit check or a cosigner. Eligibility is primarily based on your FAFSA information and your status as a student.

- Private Loans and Cosigners: Private loans often consider your credit history when determining eligibility and interest rates. If you have a limited credit history or a lower credit score, having a cosigner with good credit can improve your chances of approval and secure more favorable loan terms.

- Building Credit for Better Rates: Students with limited or poor credit should work on building their credit history by paying bills on time, using credit responsibly, and possibly obtaining a secured credit card.

7. Application and Approval Timelines

- Federal Loan Application Timeline: The FAFSA should be completed as soon as possible after October 1st each year. While the federal deadline is June 30th, states and individual schools may have earlier deadlines, so it’s crucial to check those deadlines to maximize your aid potential.

- Private Loan Approval Process: Private loan approval timelines vary by lender but typically involve a credit check. It’s advisable to apply for private loans well in advance to ensure you receive funds in time for the start of your academic term.

- Planning Your Application Strategy: Coordinating your federal and private loan applications strategically can help you cover your educational expenses without unnecessary delays.

8. Loan Consolidation and Refinancing

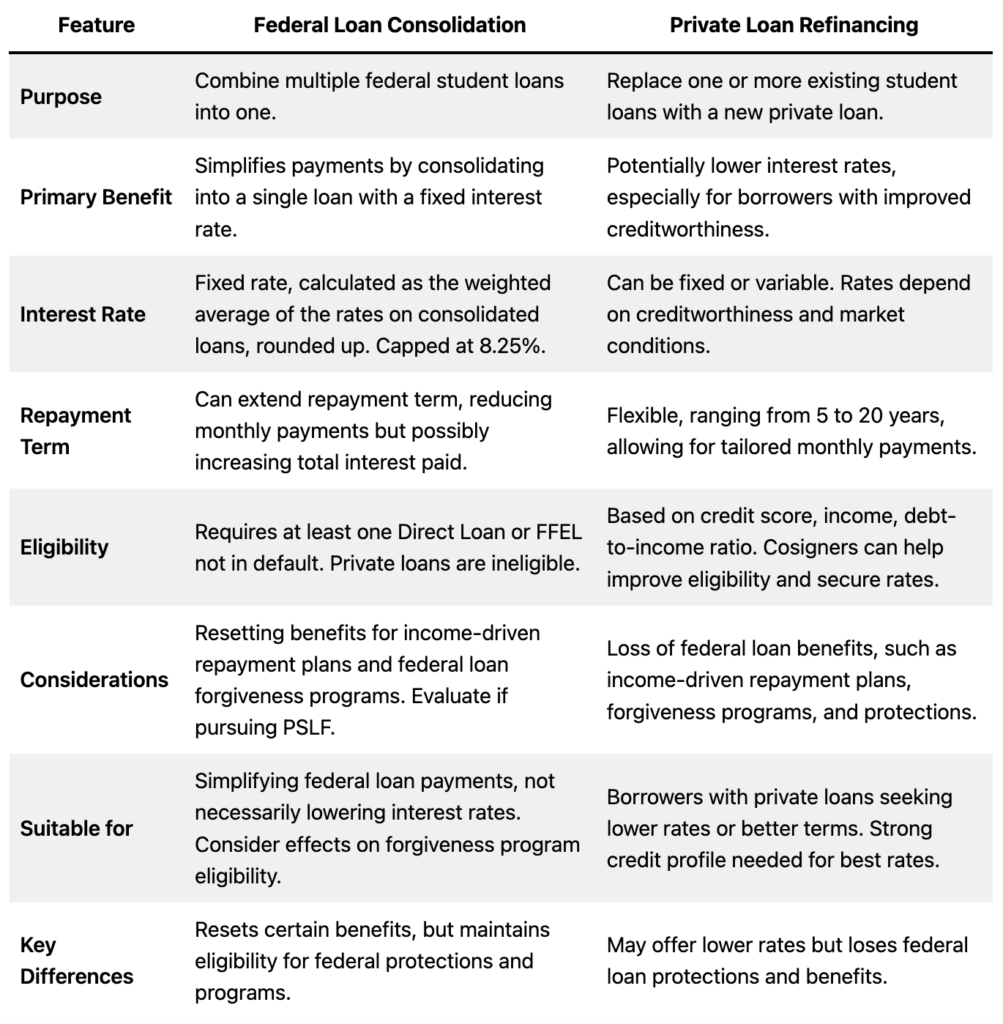

In conclusion, loan consolidation and refinancing are valuable tools for managing student loan debt. Federal loan consolidation simplifies payments but may not lower interest rates significantly. Private loan refinancing can lead to interest savings, but it’s essential to understand the trade-offs, including the potential loss of federal loan benefits. Make an informed decision based on your financial situation and long-term goals.

9. Loan Repayment Assistance Programs

Loan repayment assistance programs (LRAPs) are designed to assist borrowers in managing their student loan debt burden. These programs vary widely, with some offered at the federal level and others by employers, state governments, or nonprofit organizations. Here’s a comprehensive look at LRAPs:

Federal Loan Forgiveness Programs: There are several federal loan forgiveness programs designed to alleviate the financial burden of student loan debt. The most notable programs include:

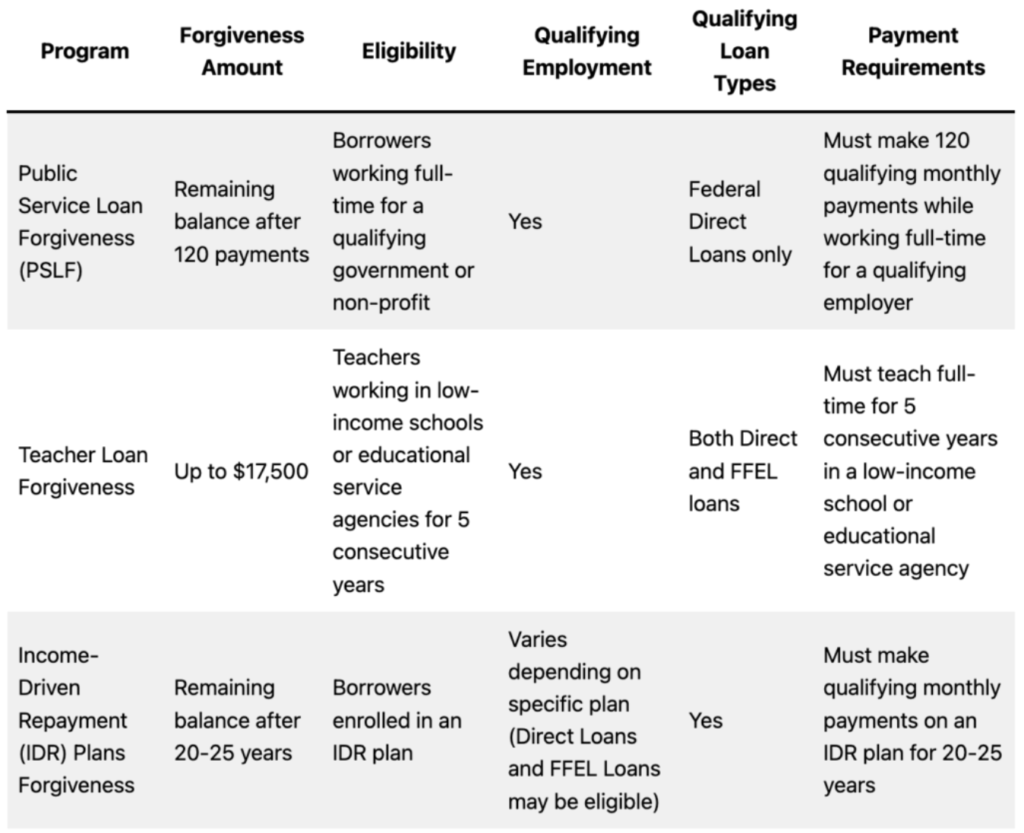

- Public Service Loan Forgiveness (PSLF): PSLF is a federal program that forgives the remaining balance on your Direct Loans after you make 120 qualifying payments while working full-time for a qualifying employer, typically a government or nonprofit organization. PSLF can be a significant benefit for those pursuing careers in public service.

- Teacher Loan Forgiveness: This program is designed for teachers working in low-income schools or educational service agencies. Depending on your qualifications, you may be eligible for forgiveness of up to $17,500 on your Direct or FFEL loans.

- Income-Driven Repayment Plans Forgiveness: If you enroll in an income-driven repayment plan (such as Income-Based Repayment or Pay As You Earn), your remaining loan balance may be forgiven after 20 to 25 years of qualifying payments, depending on the specific plan.

Private Loan Repayment Assistance: While federal programs provide significant relief, private loan borrowers may also have options:

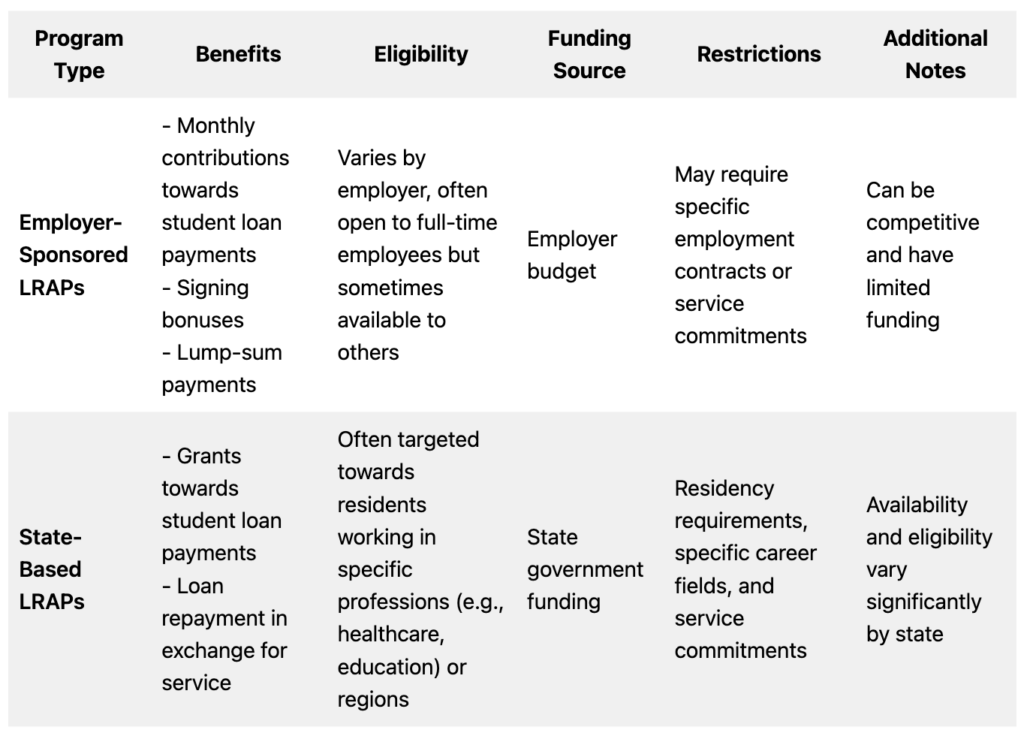

- Employer-Sponsored LRAPs: Some employers offer loan repayment assistance as part of their benefits package. This assistance may come in the form of monthly contributions toward your student loan payments, signing bonuses, or lump-sum payments.

- State-Based Programs: Several states have implemented their own LRAPs to support residents who work in specific fields or regions. These programs may provide grants or loan repayments in exchange for working in underserved communities or critical professions.

Weighing Your Options: When considering loan repayment assistance programs, it’s essential to weigh the benefits against the obligations and restrictions:

- Qualifying Employment: Most LRAPs, especially federal programs like PSLF, require you to work in specific fields or for qualifying employers. Ensure that your chosen career aligns with the program’s eligibility criteria.

- Loan Type: Eligibility for federal forgiveness programs depends on the type of federal student loans you have. Make sure your loans qualify for the program you’re interested in.

- Payment Obligations: Some programs require you to make a set number of monthly payments before you become eligible for forgiveness. For example, PSLF mandates 120 qualifying payments.

- Tax Implications: Be aware of potential tax implications associated with loan forgiveness. Under current tax laws, forgiven loan amounts may be considered taxable income, which could result in a substantial tax bill.

Alternative Strategies: In some cases, LRAPs may not be the best option, or you may want to explore additional strategies to manage your student loans effectively:

- Loan Refinancing: If you have private loans or are ineligible for federal forgiveness programs, consider refinancing your loans with a private lender to secure a lower interest rate and potentially lower your monthly payments.

- Budgeting and Financial Planning: Creating a budget and financial plan can help you allocate your resources efficiently, making it easier to manage your student loan payments.

- Side Hustles and Additional Income: Exploring opportunities for additional income through side hustles or freelance work can provide extra funds to put toward your student loans.

Conclusion: Loan repayment assistance programs can be valuable tools for managing student loan debt, particularly for those in public service or specific industries. However, borrowers should carefully assess their eligibility, obligations, and the long-term impact of these programs. Additionally, consider alternative strategies and financial planning to ensure you’re on track to meet your financial goals while efficiently managing your student loans.

10. Making an Informed Decision

Choosing between federal and private student loans is a crucial financial decision that can significantly impact your educational journey and future finances. To make an informed decision, consider the following key factors:

Evaluating Your Financial Needs:

- Determine Your Total Educational Costs: Start by estimating the total cost of your education, including tuition, fees, room and board, books, and other expenses. Be realistic about your expected expenses for the entire academic program.

- Evaluate Your Financial Aid Package: Review any grants, scholarships, work-study programs, and federal student loans offered to you through the Free Application for Federal Student Aid (FAFSA). This is the foundation of your financial aid package.

- Calculate the Funding Gap: Subtract the financial aid you’ve received from your total educational costs to determine the funding gap. This gap represents the amount you’ll need to cover through additional resources, such as private loans or personal savings.

Comparing Loan Offers:

- Federal Loans: Understand the terms and benefits of federal loans. These loans offer fixed interest rates, income-driven repayment options, loan forgiveness programs, and deferment/forbearance options. Analyze how federal loans align with your financial needs and future goals.

- Private Loans: Research private lenders, comparing interest rates, repayment terms, and fees. Be mindful of the differences between variable and fixed interest rates. Read the fine print to understand the lender’s policies regarding deferment, cosigners, and borrower protections.

- Use Loan Comparison Tools: Several online tools and calculators can help you compare loan offers. These tools often provide insights into total loan costs, monthly payment estimates, and potential savings through different repayment plans.

Seeking Professional Guidance:

- Consult Financial Aid Advisors: Reach out to your school’s financial aid office or financial aid advisors for personalized guidance. They can provide information on federal and state programs, as well as help you understand your specific financial aid package.

- Consider Loan Counselors: If you’re unsure about the intricacies of student loans, you can seek assistance from loan counselors or financial advisors. They can provide expert advice tailored to your financial situation.

Long-Term Financial Planning:

- Assess Future Earnings Potential: Consider your field of study and expected career path. Research the typical salary ranges for professionals in your chosen field. This information will help you gauge your ability to repay loans after graduation.

- Create a Repayment Strategy: Develop a repayment strategy that aligns with your expected income and financial goals. Decide whether you prefer to pay off loans aggressively to minimize interest costs or opt for more flexible income-driven repayment plans.

- Emergency Fund and Other Financial Goals: Prioritize building an emergency fund and addressing other financial goals alongside repaying your student loans. An emergency fund can provide a financial safety net in case of unexpected expenses.

Consider Your Risk Tolerance:

- Risk vs. Reward: Evaluate the risks and rewards associated with each type of loan. Federal loans offer borrower protections and benefits, making them a lower-risk option. Private loans may have higher interest rates but can be a viable choice for borrowers with strong credit and the ability to manage their debt responsibly.

Choosing the Right Path:

- Decision Time: After conducting thorough research, consulting professionals, and assessing your financial situation, it’s time to make a decision. Consider your comfort level with debt, your career prospects, and your long-term financial goals.

- Loan Agreement Review: Before accepting any loan offer, carefully review the loan agreement. Ensure you understand the terms, interest rates, repayment schedule, and any associated fees. Don’t hesitate to ask the lender for clarification if needed.

- Commitment to Responsible Borrowing: Regardless of whether you choose federal or private loans, commit to responsible borrowing practices. Only borrow what you need and can reasonably repay. Stay informed about your loan terms and keep track of your repayment progress.

Conclusion: Choosing the Right Path for Your Education

By following this comprehensive guide, students and their families can confidently navigate the complexities of federal and private student loans, ultimately choosing the financing option that best suits their unique circumstances. Remember that making an informed decision is the first step toward a successful and manageable college journey.