The cost to attend college increases every year. For 2023, the average cost to attend college at a public university was $26,027 for in-state residents and private universities cost an average of $55,840.

Table of Contents

Even if your parents saved money for you to go to college, chances are you’ll need student loans at some point. Most students have the option of federal and private student loans. It’s best to exhaust your federal student loan options since they usually have lower interest and fees. Plus, you may get more assistance should you be unable to afford your payments when they’re due.

What is a Student Loan?

A student loan is money you borrow from a lender to pay for school-related expenses. You can borrow money to cover tuition and fees, room and board, as well as the cost of supplies such as textbooks and computers.

You’ll be charged interest on the loans you borrow, but in the case of federal loans, won’t have to make payments right away. Most payments are deferred while you’re still in school. On average, you’ll pay 5% – 7% on student loans, but it varies by lender and loan type.

How to Get Federal Loans

To qualify for federal student loans, the Free Application for Federal Student Aid must be completed every year, even after you’ve received student loans. The application becomes available on October 1st of each year and is open until June 30th of the following year.

To qualify for federal student aid, you must:

- Prove you have financial need (this is determined with the FAFSA)

- Be a US citizen with a social security number and registered with the Selective Service if you’re a male over 18

- Attend college at least half time in an eligible degree program

- Stay within the school’s academic success ratings (this varies by school)

The Two of Direct Federal Loans

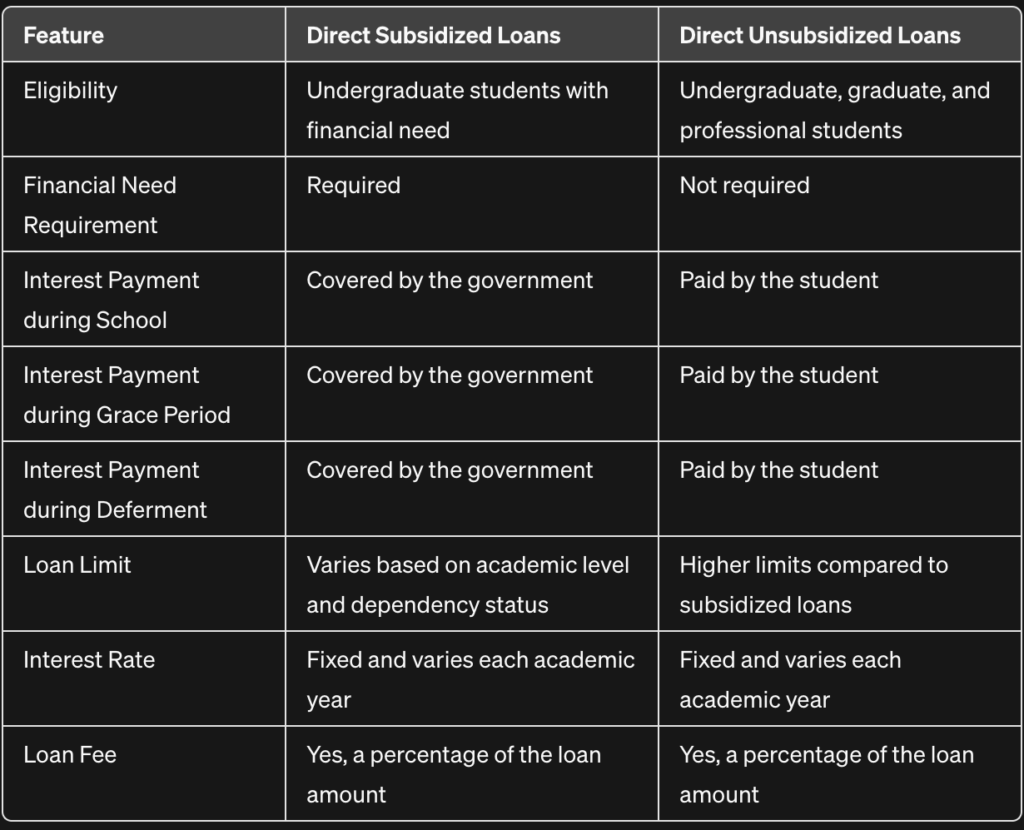

There are two main types of Direct Federal loans – Direct Subsidized Loans and Direct Unsubsidized Loans. Most students qualify for the Direct Loan Program. Let’s compare the two:

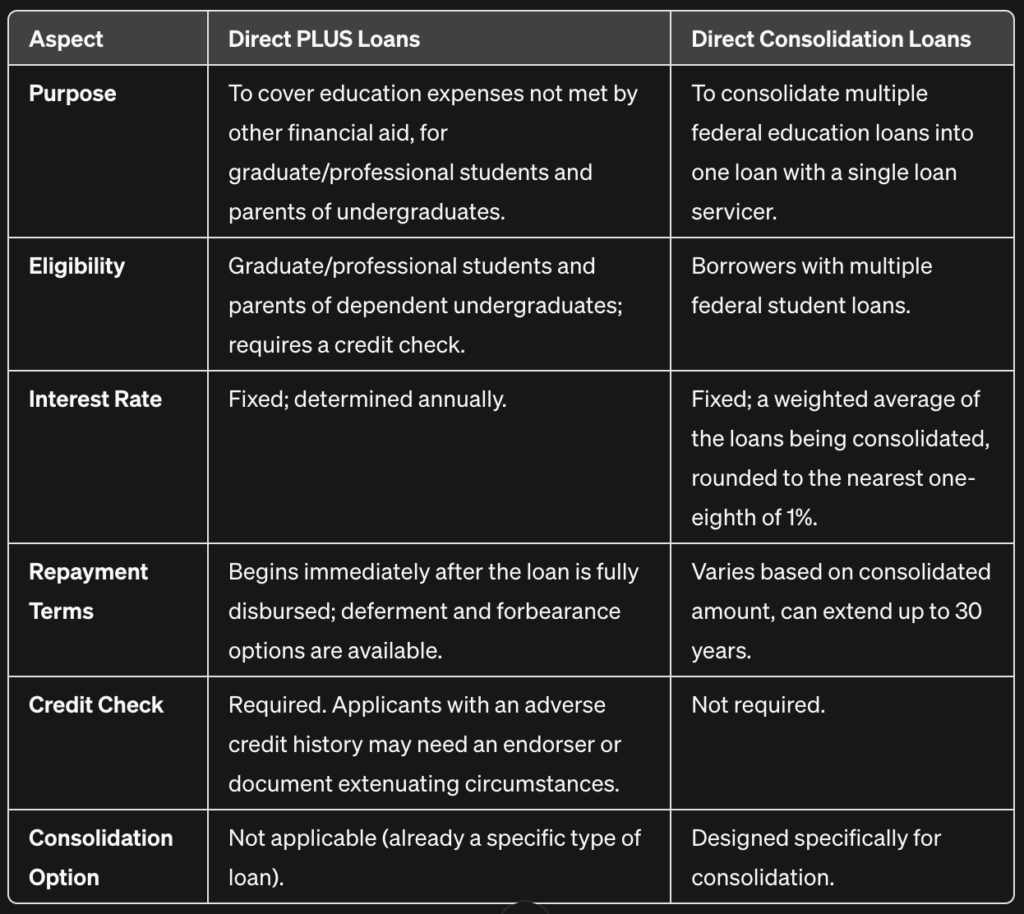

Other Types of Direct Federal Loans

How to Get Private Loans

Private student loans are harder to get because they aren’t backed by the government. They are issued by private banks and lenders, each of which has its own qualifying requirements.

It’s best to exhaust all options for federal student aid before applying for private loans. Some students take as much federal student aid as possible and then supplement it with private student loans.

To qualify, you must prove to the lender that you have a solid credit history. Since many college students don’t have a credit history, though, they often need a co-signer to get approved and/or get the best interest rates.

What you Should Know About Private Student Loans

Unlike federal student loans, private student loans often don’t have a grace period. This means payments might be due while you’re in school. While this knocks the principal down faster, it can be hard to afford payments while you’re in school.

Private lenders aren’t as flexible when you’re in the repayment period either. You have many options to defer or consolidate federal student loans if you can’t afford them, but private lenders don’t offer the same options.

Private student loans also have variable interest rates, which means that the interest rates change over time. This means that there potentially can be higher payments.

How to Repay Student Loans

Whether you borrow federal or private student loans, you must repay them at some point. Federal student loans have more options when it comes to financial difficulty. Let’s see what paying off federal student loans looks like compared to private student loans.

Repaying Federal Student Loans

Federal student loans aren’t due while you’re in school. Interest accrues but you don’t have to make any payments (although paying the interest payments is a good idea).

The grace period lasts for up to 6 months after you graduate and/or stop going to school.

When payments begin, all borrowers get the standard repayment option. This means your loan is amortized over 10 years. But if you can’t afford the payment, you can apply for a repayment program.

Many of the federal repayment programs are based on your income. With some programs, you can even get your payment down to $0 if you aren’t making enough money. This doesn’t mean you’ll never owe the money back though. With some programs, it just defers the payments, but others have loan forgiveness features that cancels a portion of your loan after a certain number of payments.

Repaying Private Student Loans

Private lenders each have their own repayment requirements. Some defer payments while you’re in school, but payments start immediately after graduation. Others require payments while you’re in school, but it might be just the accrued interest.

Private student loans can be amortized over 25 years in some cases but look at the bottom line to make sure it’s something you want since the overall interest on such a long loan term will be high.

Final Thoughts

Student loans are a great way to help you afford college, but never over borrow. Exhaust all of your options for free aid, such as scholarships and federal grants first. Next, look at federal student loans, only opting for private student loans when you’re out of options.

Many of the federal programs available are first come, first serve. Complete your FAFSA as close to October 1st as possible and look into all programs you can apply to that might help you lower your cost of going to college.